- #Elster online de eportal registration#

- #Elster online de eportal code#

- #Elster online de eportal professional#

Consequently, you may want to consider engaging a German tax consultant to carry out this task on your behalf as these professionals have special access rights to .īased on that information, the finance office will calculate the real estate value and property tax assessment basis to be used by the municipalities in setting the new annual property tax. Moreover, the schedule is only available in German and needs to be completed when logged on.

#Elster online de eportal registration#

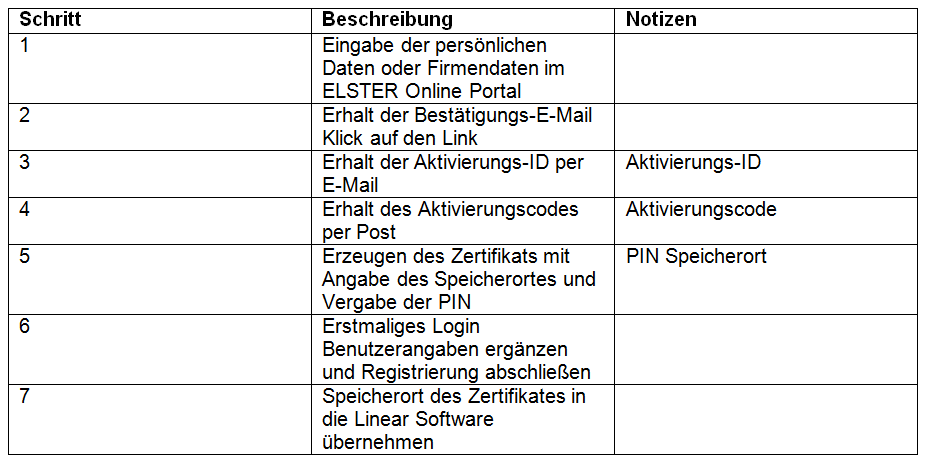

In order to allow for a proper assessment real estate owners have to submit electronically a tax return schedule with information on the location of the real estate, its size, the standard land value, the type of building, living space size, and the year of construction… The new schedule from will be released on July 1, and needs to be summited no later than October 31.Ĭompliance requires registration on the online tax platform.

Independent of the above-stated census concerning real property and buildings and in addition to it, ALL real estate owners have to submit a data collection return during the period July1 through October 31. While property tax continues to be assessed on an annual basis at the level of the German municipality in which the real estate is located, the calculation will now change. Therefore, they enacted new real estate property tax laws. The German States have been required to implement a property tax reform (“Feststellung des Grundsteuerwerts”). You are also required to comply with a data collection effort related to property tax. Failure to comply can ultimately trigger a fine.ĭata collection for proerty tax reassessment In the alternative, you can talk to the interviewer directly.

#Elster online de eportal code#

After entering the access code contained in the letter requesting your participation, you can switch the language on the website from German to English. The census questionnaire can be completed online at. Persons who own real estate in Germany are obligated to comply. It applies to ALL owners of such property. The second census deals with real property and buildings (“Befragung zur Gebäude- und Wohnungszählung”). Therefore, if selected, you are NOT required to participate in the population census, but should inform the interviewer about your SOFA status.Ĭensus concerning real property and buidlings Forces personnel with status under the NATO Status of Forces Agreement are exempt from German regulations in the field of registration of residence and aliens control. It aims to gain data on persons and their economic family situation. The participation criteria is based on residency and registration. Ten percent of the population residing in Germany will be randomly selected and interviewed for the population census (“Haushaltsbefragung”). In addition, real property owners have to respond to yet another letter from the German tax office concerning data collection related to property tax reassessment. Forces personnel are not required to respond to the first but, if they own real property in Germany, are required to respond to the second. There are two German censuses that are occurring this summer: a population census and a real property census. However, if you own any real estate in Germany, you will be required to respond to one special type of German census. Forces personnel are exempt from most German registration and census laws. Information required on German invoices: Germany – May 16, 2022: official government survey for census (population, building and household) in Germany. Since, the tax registration with the corresponding "Questionnaire for tax registration" (‘Fragebogen zur steuerlichen Erfassung’) must be made online via "Mein ELSTER". The taxpayer needs to register at the tax office. The request needs to be directed towards the tax office within the county of residence of the taxpayer. In order to become registered for the tax payment it is necessary to request a tax number within four weeks upon the beginning of the self-employment. Kleinunternehmer, who had an income of less than 22.000 Euros during the last year and are prospectively not going to earn more than 50.000 Euros during the current year can decide for themselves whether or not they want to charge and pay a value added tax. However, they are eligible to declare themselves a ‘small business’ (Kleinunternehmer). Self-employed individuals are obliged to pay a value added tax (VAT).

In Germany self-employed individuals are obliged to pay income taxes and need to submit an annual tax declaration. The basic tax-free amount is 9.984 Euros in 2022 for singles (Retroactive increase planned to 10.347 Euros). Most occupations in the arts are considered as self-employment. What we have achieved: exhibition payments, grants, art production infrastructur.

#Elster online de eportal professional#

0 kommentar(er)

0 kommentar(er)